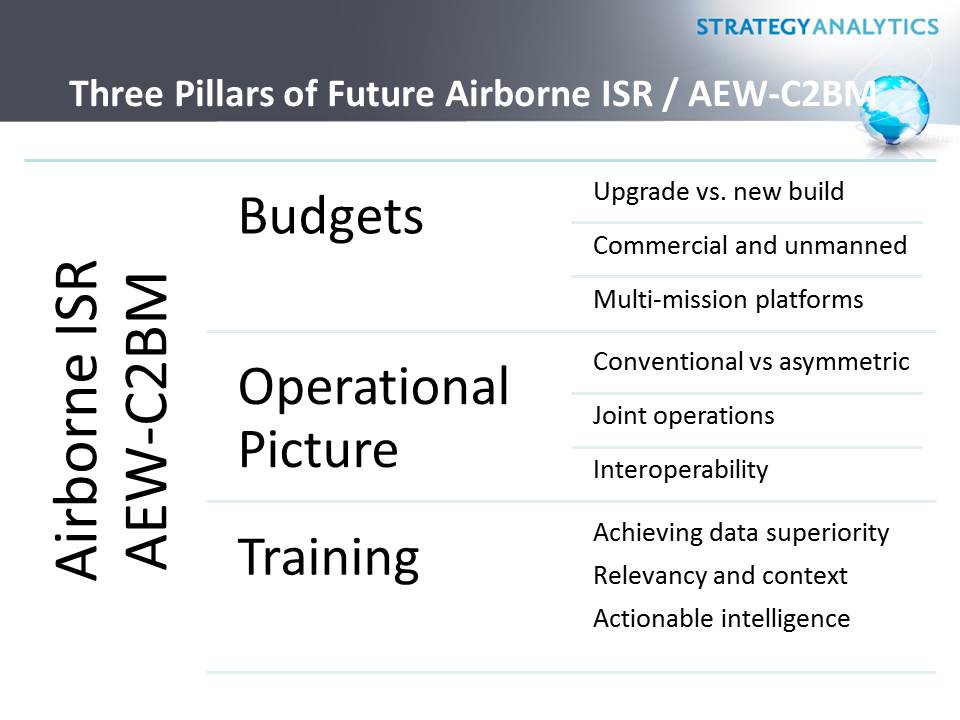

Three Pillars for Future Airborne ISR / AEW-C2BM

Strategy Analytics attended the inaugural IQPC Airborne ISR and C2 Battle Management event which took place in February (25 - 27 February) to explore the increasing convergence in recent years between ISR (Intelligence, Surveillance and Reconnaissance) and AEW (Airborne Early Warning)/Command and Control Battle Management (C2BM) mission sets. Budgets, the changing operational picture and training will be the three pillars for future airborne ISR as it increasingly converges with AEW/C2BM operations. The Strategy Analytics Advanced Defense Systems (ADS) service report, “Three Pillars for Future Airborne ISR / AEW-C2BM” examines the factors that will influence future airborne ISR/AEW-C2BM operations and the associated market opportunity for platform manufacturers and the supporting supply chain.

The ultimate goal for airborne ISR and AEW/C2BM is to enable decision superiority and this will continue to be enabled by the confluence of hardware assets and the operators and analysts. Budgets will underpin the makeup of future capabilities and dictate the economics of introducing new platforms versus upgrading capabilities as existing platforms approach critical junctures in their operational lifecycle. In the case of radar systems, demand will come from existing platforms being retrofitted and upgraded, as well as opportunities from new manned and unmanned platforms, driving shipments a CAGR of 5 percent through 2022.

The ultimate goal for airborne ISR and AEW/C2BM is to enable decision superiority and this will continue to be enabled by the confluence of hardware assets and the operators and analysts. Budgets will underpin the makeup of future capabilities and dictate the economics of introducing new platforms versus upgrading capabilities as existing platforms approach critical junctures in their operational lifecycle. In the case of radar systems, demand will come from existing platforms being retrofitted and upgraded, as well as opportunities from new manned and unmanned platforms, driving shipments a CAGR of 5 percent through 2022.

The changing face of warfare (conventional versus asymmetric) moving towards hybrid scenarios will be underpinned by joint operations and will require interoperability to allow effective operation in congested and contested environments. Ultimately, the emphasis needs to be on information sharing, not collection of data for collections sake.

Despite the move towards advanced sensors, automated software capabilities and unmanned platforms, the "human-in-the-loop" remains the most important asset. The importance of continued and effective training will be essential to ensure that platforms and assets achieve the desired effects.

Conventional Airborne Electronic Warfare will be a Future Priority

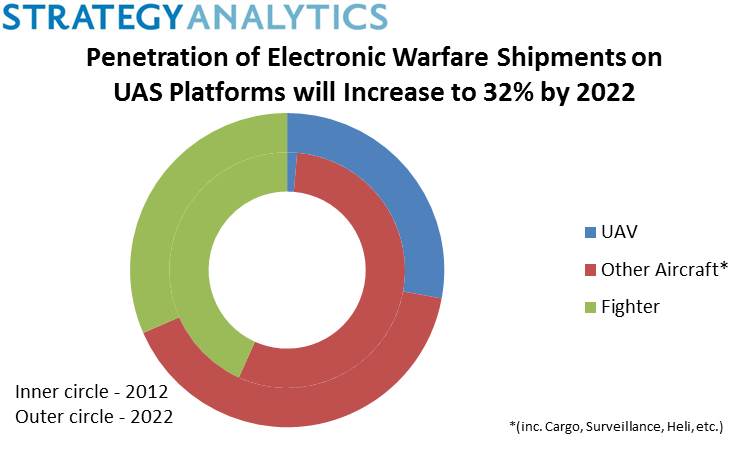

Global spending on RF-based Electronic Warfare (EW) systems is forecast to grow to over $9.3 billion through 2022. The Strategy Analytics Advanced Defense Systems (ADS) service forecast model, “Airborne EW (EA) Systems and Components Forecast 2012-2022,” predicts that a future emphasis shift back towards re-establishing airborne EW capabilities that can counter anti-access, area-denial systems will translate into spending on airborne EW systems accounting for over 35 percent of this global spending.

Global spending on RF-based Electronic Warfare (EW) systems is forecast to grow to over $9.3 billion through 2022. The Strategy Analytics Advanced Defense Systems (ADS) service forecast model, “Airborne EW (EA) Systems and Components Forecast 2012-2022,” predicts that a future emphasis shift back towards re-establishing airborne EW capabilities that can counter anti-access, area-denial systems will translate into spending on airborne EW systems accounting for over 35 percent of this global spending.

The renewed focus on Electronic Attack (EA) capabilities will provide opportunities for conventional platforms dedicated to EW capabilities, e.g. Boeing's EA-18G as well as other fast-jet and aircraft platforms. This will be supplemented by the potential capabilities that fifth generation platforms such as the F-35 will bring, underpinned by systems such as the Next Generation Jammer (NGJ), as well as air-launched, podded and towed systems. The analysis also forecasts increasing penetration of EW payloads on UAS platforms, with shipments accounting for 32% of total EW system shipments in 2022.

The increasingly congested and complex spectrum environment will require capable EA systems that are able to operate across wider bandwidths to enable full protection of assets. This emphasis will translate to the associated market for components growing at a CAGR approaching 10 percent through 2022. The emphasis on delivering digital flexibility will drive demand for Digital Radio Frequency Memory (DRFM)-based jammers. The need to provide wide bandwidth and high power will enable the GaN semiconductor opportunity to grow at a CAGR of over 45 percent.

Join Strategy Analytics for Electronic Warfare Europe 2014 (Edinburgh, UK, 13th-15th May). This event is a leading conference and exhibition in Europe in 2014 and will be of interest to leaders and operators across government, defence and industry that are shaping the future of EW. Topics covered during the Symposium sessions will include national perspectives, technological developments and future outlook, and will be complemented with an exhibition providing an opportunity for networking. The Strategy Analytics team will be on hand and available for one-to-one meetings to discuss trends out outlook for the EW sector.