Figure 1 Predator A (a) and Predator C (b) UAS platforms (courtesy of General Atomics).

They call it the “Hidden War” – the United States’ secret use of unmanned autonomous vehicles (UAV) to search out and kill terrorists overseas. It has created a lot of controversy recently and receives increasing mainstream news coverage. Where is the technology heading? What are the risks and business opportunities for RF and microwave companies? This article takes a look at the UAV (or “drone”) market, recent progress in the technology and future directions related to the RF and microwave industry.

UAV LANDSCAPE

The most commonly seen UAVs are Unmanned Aircraft Systems (UAS) that include ground stations and other elements besides the actual aircraft. UASs get the most public coverage of all UAVs that also include Unmanned Ground Systems (UGS) and Unmanned Maritime Systems (UMS). The most widely known UAS is the Predator A (see Figure 1a), which began as a reconnaissance platform and was later modified to carry Hellfire anti-tank missiles. The Predator B (Reaper) was a second generation with improved performance capabilities. The third generation Predator C (Avenger, see Figure 1b) is more in line with the fifth generation fighters being deployed by the USAF. The Avenger UAV uses existing Predator ground-based infrastructure so the costs to field it are just the UAV and software itself, avoiding the cost of a full new system. The Avenger has a jet-powered engine and stealth technology that was not used in the previous Predator platforms. The Predator UAV and sensors are controlled from a ground station via a C-Band line-of-sight data link or a Ku-Band satellite data link for beyond-line-of-sight operations. The Avenger is fitted with the General Atomics-developed “Lynx” Synthetic Aperture Radar (SAR) system as well as the AESA Wide-Area Surveillance Sensor.

Figure 2 Wasp III UAS (courtesy of Aerovironment Inc.).

Figure 3 DARPA Legged Squad Support System UGS (courtesy of DARPA).

Another class of UASs is micro- or mini-UASs. This is a growing area as these are less expensive, easier to deploy and becoming more capable as the software control improves. An example is the Wasp III, which provides real-time direct situational awareness and target information for Air Force Special Operations Command Battlefield Airmen. The Wasp III UAS features the expendable air vehicle, a ground control unit and communications ground station. It is a collapsible lightweight air vehicle with a two-bladed propeller driven by a small electric motor (see Figure 2). It is equipped with an internal GPS and Inertial Navigation System, autopilot and two on-board cameras. The system can function autonomously from takeoff to recovery or be controlled by one operator using a handheld remote control unit.

Figure 4 iRobot 110 FirstLook "throwable" UGS (courtesy of iRobot).

Unmanned Ground Systems (UGS) are an over-looked class of UAVs with many thousands of vehicles used in the Iraq and Afghanistan wars to locate and defuse IEDs or explore potentially dangerous buildings. It has been reported that as of 2011, more than 11,000 IEDs were defeated using UGSs. Other UGSs are designed to go into buildings and provide visual images of what is inside while others are designed to carry equipment to support troops. Many UGSs use treads like a tank for movement but DARPA is working on legged UGSs for carrying equipment like a mule. The DARPA project is called the Legged Squad Support System and is shown in Figure 3. It can carry heavy loads and would therefore be able to support troops by hauling equipment.

For UGS recognizance, there are many kinds of vehicles with cameras and sensors that can enter a building or other areas that pose a risk to humans and take a look remotely at what is there. Some examples are sending UGSs into areas contaminated with chemicals, under bomb threats or radioactive contamination. The UGSs can survey the area for possible problems without endangering humans. An interesting example is the iRobot FirstLook as shown in Figure 4. It is a small, light, throwable robot that provides quick situational awareness, performs persistent observation and investigates confined spaces. One can just toss it into a building (through a window or door) and immediately get images as to what is inside as it is guided around the area. Historically, the emphasis has been on IED and bomb detection and defusing but as the Middle East wars wind down, it is expected that the emphasis will change to other uses such as border security and law enforcement applications.

Unmanned maritime systems (UMS) consist of unmanned underwater vehicles (UUV) and unmanned surface vehicles (USV). The U.S. government’s priorities for UMS include mine countermeasures, anti-submarine warfare, maritime domain awareness and maritime security.1 UMSs have been widely used in mine sweeping operations in several wars. Examples of maritime security UMSs are the SeaFox USV shown in Figure 5 and the Sea Maverick UUV shown in Figure 6. UMSs are used for military maritime security and border security. With large amounts of illegal drugs entering the U.S. coming from underwater or surface vehicles, border security is expected to be a growing area for all types of UAVs, especially UMSs.

Figure 5 SeaFox USV (courtesy of Defence Talk).

Figure 6 Sea Maverick UUV (courtesy of Autonomous Undersea Vehicle Applications Center).

UAV MARKET

The UAV sector has recently been called the fastest-growing sector in the aerospace industry by the Teal Group, a defense industry consultant.2 Current global UAV sales are about $6.6 billion annually and are expected to double over the next decade. The U.S. military UAV market is projected to grow at a CAGR of 12 percent between 2013 and 2018, according to a Market Research Media report.3 The report says that the U.S. military UAV market will generate $86.5 billion in revenues over the period 2013-2018. Market demand is anticipated to be driven by increased UAV procurement for applications such as persistent surveillance, suppression/destruction of enemy air defense, and communications relays and combat search and rescue.

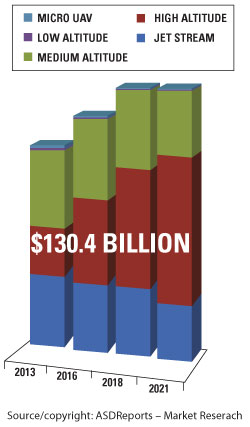

Figure 7 Projected funding profile for UAV market (courtesy of ASDReports).

ASDReports offers another market trend analysis over the next five years. They project that NATO nations (especially the U.S.) will reduce their investment in defense and security UAVs while the non-NATO world will move into those military and police UAVs in a relatively big way. The resultant global market will exceed a cumulative $130 billion over the coming eight years, but the funding profile will change considerably (see Figure 7).4 The U.S. DoD is changing its focus from Counter Insurgency to a more traditional conflict against a near-peer. That move will reduce the need for expensive UAVs, but will increase the need for fast, stealthy, survivable UAVs.

The U.S. plans to cut spending on unmanned aerial vehicles in fiscal 2014 by one-third of the amount over the previous year, mostly because of the winding down of operations in Afghanistan and the end of the U.S. military role in Iraq. While the war on global terrorism initially drove the U.S.’s use of UAVs, it is predicted that there are a wide variety of other uses that will allow the growth to continue including civilian uses. Current civilian applications include Homeland Security, disaster management and border surveillance. The AUVSI Economic Report 20135 states that the planned opening up of the national airspace to UAVs in the U.S. by 2015 will affect the market potential between 2015 and 2017 by some $13.6 billion, and $82.1 billion between 2015 and 2025. However, it predicts that if the effort is delayed, it will cost the U.S. billions of dollars in potential revenue. For each year of delay, some $10 billion of potential economic impact is lost. So establishing the guidelines for UAVs to operate in U.S. airspace is critical for domestic growth.

Another obstacle to commercial use is privacy issues which are raising objections in the public’s eye. It was revealed for the first time in mid-June that the FBI has been using UAVs in the U.S. for law enforcement activities. About a dozen operations were disclosed including surveillance of a man that was holding a young boy hostage in Alabama. The government stated that they are only used on a very limited basis but this immediately outraged some of the privacy advocate groups.

While UAVs are already used in a range of civil applications, including wildfire mapping, weather monitoring and telecommunications, the

AUVSI report outlined other potential uses that UAVs could carry out, such as precision agriculture and public safety. These applications are thought to make up about 90 percent of the known potential markets. UAVs have many applications in public safety such as search and rescue, surveillance, bomb defusing, surveying dangerous areas (chemical or radiation threats) and following suspects, to name a few. Farmers are already using UAVs to monitor their crops’ health from the air to see problems with insects or disease before they become too large to address. This also allows for targeted insectiside application reducing the need to use these chemicals. The report predicts that these two markets will produce approximately 90 percent of the known potential future markets for UAVs.

Outside of the U.S., the demand for UAVs is expected to grow as the technology becomes more widespread. Israel and India are two markets that many analysts are predicting will experience high demand. We have even seen recent use of UAVs by Hezbollah entering into Israeli air space, as they have been shot down by the Israeli defenses. Advanced Defense Technologies Inc. has projected that India is a booming market for micro- and mini-UAVs for civilian and military use.6 They expect UAVs to be used for reconnaissance and mapping, surveillance, border and maritime patrol.

Israel has been reported to be the largest exporter of UAVs with $4.62 billion from 2005-2012.7 Britain, India and Brazil are reported to be Israel’s leading customers. While the U.S. is constrained with ITAR restrictions that prevent easy export of restricted products, Israel has been able to take the lead in the UAV market. Saudi Arabia recently decided to purchase UAVs from South Africa as the U.S. was reluctant to provide armed UAVs to a Middle Eastern country.

UAV RISKS

The movement of UAVs from innocuous surveillance tools to potential killing machines has brought UAVs to the national stage. The Bush and Obama administrations’ use of UAVs to target and assassinate terrorists has spurred debates and concern over how these decisions to kill someone are determined. Is it even legal to kill Americans who are terror suspects without due process? Up until a few months ago, only one American was known to have been killed but President Barack Obama recently disclosed that the U.S. government has killed four Americans. Right after that disclosure, he announced a new classified policy that imposed tougher standards for when UAV strikes can be authorized, limiting them to targets who pose ‘‘a continuing, imminent threat to Americans’’ and cannot feasibly be captured. The new “guidance” also begins a process of phasing out the CIA from the UAV war and shifting operations to the Pentagon. This is an effort to make the process more transparent so it is viewed as less secretive.

Another important issue in this debate is collateral damage from UAV strikes. The Obama administration is believed to have launched more than 300 UAV strikes and numerous non-combatants have been killed, including many women and children. From 2006-2009, UAVs killed between 750 and 1000 people in Pakistan, according to the New American report.8 Of these, about 20 people were leaders of Al-Qaeda, Taliban and associated groups and overall, about 66 to 68 percent of the people killed were militants with 31 and 33 percent being civilians,7 – though U.S. officials disputed the percentage for civilians. According to Britain's Bureau of Investigative Journalism, UAV attacks targeting suspected Al-Qaeda and Taliban militants in Pakistan have killed up to 3587 people since 2004, including up to 884 civilians.9 This comes out to about 25 percent of those killed being civilians. The government has weighed this against the risk to U.S. citizens and military lives that might have been lost in alternative missions.

UAV missions often provide the lowest risk to U.S. lives versus other options. Also, UAVs can simultaneously track targets and take them out which is difficult to do with any other type of mission. As a result, UAVs are considered the lowest risk option and chosen for these types of missions. With these risks in mind, any new sensor, weapon or decision making technologies that can reduce collateral damage are critical to future systems. Technologies such as better through-the-wall imaging or improved resolution imaging from longer distances would be welcome improvements that RF and microwave companies might be able to offer as new capabilities.

UAV TECHNOLOGY CHALLENGES

There are many challenges to improving UAV capabilities, integrating them into the national airspace and having them cooperate with manned vehicles. These challenges represent opportunities for companies as to the technology needed for future UAV programs. A couple of years ago, the Department of Defense (DoD) released The Unmanned Systems Integrated Roadmap FY2011 — 2036 projecting the U.S. governments priorities and plans for UAVs.7 It lists the following challenges facing military departments:

- Interoperability: UAVs need to operate seamlessly across domains and with manned systems.

- Autonomy: Pursue technologies and policies that introduce a higher degree of autonomy to reduce the manpower burden and reliance on communications links while also reducing decision cycle time.

- Airspace Integration: Ensure UAS have routine access to the appropriate airspace needed within the National Airspace System working with the FAA.

- Communications: Continue to address frequency and bandwidth availability, link security, link ranges, and network infrastructure.

- Training: Ensure continuation and joint training that will improve basing decisions, training standardization.

- Propulsion and Power: Continue to develop more efficient and logistically supportable sources for propulsion and power.

- Manned-Unmanned Teaming: Continue to implement technologies and evolve tactics, techniques and procedures that improve the teaming of unmanned systems with the manned force.

The interoperability of sensors and improvement in communications bandwidth challenges offer RF and microwave companies the opportunity to develop new technologies that can meet these needs. Standard sensors that can be used across multiple platforms and wideband/high-frequency transmitter/receiver systems are a couple of the solutions that could help meet these challenges.

RF SYSTEM CHALLENGES

Most important to RF and microwave companies, the roadmap discusses many suggested approaches for future developments that are addressed with microwave technology especially in the area of communications. Antennas for UAVs require high-gain, rugged, and low cost multidirectional antennas. It states that phased array antennas and “smart” antennas offer an alternative to traditional dish antenna, but they require tradeoffs among size, weight and power (SWaP). The industry will need to continue developing such techniques as multi-focused and super-cooled antenna systems. The roadmap explains that future antenna systems need to be able to send and receive signals over a broad range of frequencies. While phased arrays are a viable approach, they need to be conformal (e.g., using metamaterial) so that they will be molded within the vehicle surfaces. The utilization of common apertures requires the development of new interference mitigation methodologies that minimize co-site interference effects and improve the potential for achieving simultaneous transmit and receive operations within adjacent frequency bands.

The report also mentions that MIMO is a proven technology currently being used in commercial 4G wireless systems and would utilize multiple paths (although not necessarily independent) with lower data rates on each path; apply space-time coding and capacity optimization to achieve a total high data rate mission; apply power saving to jammer margin; and evaluate performance in benign and stressed conditions.

For transmitter and receiver systems, GaN SSPAs can offer more than double the efficiency of GaAs amplifiers, increased operational bandwidth, and wider frequency range of operation. The high transmit efficiency of GaN systems reduces the cooling requirements. In order to achieve some of these benefits, amplifier designs need to utilize technologies such as predistortion correction, envelope tracking, etc., to improve efficiency and performance. Some of these GaN technologies are currently available for selected frequency bands and plan to be in service in 2014. Instantaneous bandwidth performance and analog-to-digital converter sampling speeds have continued to improve system performance so this should continue to improve systems. The report mentions that improvements in integrated chip fabrication methods have allowed for significant miniaturization and reductions in part counts and for various transmit/receive and antenna functions and components to be integrated on a single chip this year. Most of these improvements are aimed at reducing SWaP.

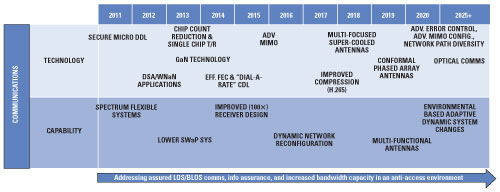

Figure 8 Projected communications technologies timeline (courtesy of Department of Defense).1

Many U.S. military operations are now taking place in parts of the world where adequate spectrum is not available. Broader bandwidths are needed to deliver timely data to the warfighter and transfer data to UAVs. Additionally, mission areas are becoming more spectrally noisy. DARPA’s Next Generation (XG) project and its follow-on Wireless Network after Next (WNaN) program demonstrated the feasibility of dynamic spectrum access (DSA). DSA offers the ability to change frequency band use based on other adjacent spectrum-dependent systems actual use and nonuse of certain bands.

Communication systems need to implement more robust anti-jamming and secure communications techniques. Networking of multiple unmanned systems may be necessary to better ensure connectivity of the systems in non-LOS, urban, hostile, and noisy EMS environments to transfer the collected information. One concept under development with DARPA is the LANdroids program. This program calls for the deployment of small, inexpensive, smart robotic radio network relay nodes that can leverage their mobility to coordinate and move autonomously. Figure 8 shows a summary of the projected communications technologies on a timeline for planned implementation. Most of these improvements involve RF and microwave technology that companies can contribute expertise to developing.

As miniaturization is a growing trend for UAVs, reducing electronics size and weight is becoming more important. RF and microwave companies offering reduced power consumption devices and highly integrated ICs have an advantage in the marketplace. Lightweight cabling and connectors are also an important technology for future systems.

FUTURE DIRECTIONS

Interoperability

Interoperability is a big challenge to UAVs and the systems that support them. To achieve the full potential of unmanned systems, these systems must operate seamlessly across the domains of air, ground and sea and also operate with manned systems. Initially many of the UAVs were developed as a single system and used as proprietary systems so they are not compatible with each other. Many of them were procured in a rush to meet an immediate wartime need so there was no time to plan for interoperability. Going forward, the U.S. government plans to use an open architecture for systems to operate together and to use common plug-and-play sensors. This extends from sensors to data collection to system controls. Designing sensors and subsystems that can be utilized on many UAV platforms will also be a trend as the government tries to reduce costs and be able to distribute spare parts around the world. These parts could be shared between systems, agencies and maybe even non-military groups.

As a first step in this direction, the Office of Naval Research has recently developed software that can be shared across the range of UAVs in an effort to save money and streamline training. The Unmanned Aerial System Control Segment (UCS) software for the Common Control System has been successfully tested during a dry run on the ground and will be used in a test flight with a UAV later this year.

Airspace Safety

UAVs designers also need to prove that their UAVs can safely operate in the same airspace as piloted aircraft before they will be allowed to fly in commercial airspace. UAVs need to demonstrate a high level of operational robustness and the ability to “sense and avoid” other air traffic. Therefore, NASA has developed the Unmanned Aircraft Systems Airspace Operations Challenge (UAS AOC) that is focused on developing some of the key technologies that will make UAS integration into the National Airspace System possible. This Centennial Challenge will be conducted in two parts: Phase 1 is scheduled to be held in spring of 2014 and Phase 2 will be approximately one year later.10 Phase 1 focuses on important aspects of safe airspace operations and robustness to system failures, and seeks to encourage competitors to get an early start on developing some of the skills critical to Phase 2.10

Another step in this direction of establishing the safety of UAVs in commercial airspace is that the FAA has issued a request for proposal for six ranges that will be used to test UAVs as part of the government’s plan to integrate the technology into national airspace. Establishing the test sites is a component of the FAA Modernization and Reform Act of 2012 with the goal of fully integrating UAVs into the airspace by 2015.

Figure 9 British UAV Taranis (courtesy of BAE).

Autonomy

The next evolution in UAVs is autonomy. UAVs currently perform minimal tasks on their own relying on their operators to make most decisions – some behavior is automatic but not necessarily autonomous. An autonomous system has the ability to be goal-directed in unpredictable situations making its own decisions. Some think taking control from humans and giving it fully to machines is a bad idea (especially after watching Terminator or The Matrix), but in order to take UAVs to the next level to perform more tasks in an efficient manner, autonomy is needed. While many of the challenges to autonomy are software related, inputs to the software regarding the surrounding environment come from sensors. Higher resolution and improved sensors with fast response time will help enable autonomy.

Some UAVs are already starting to incorporate this type of technology into their designs. Britain’s new stealth bomber UAV, Taranis, is being designed to self-evade without input from a controller. It can also independently identify targets and would only check back with a human controller before initiating an attack. This UAV is relatively large at with a wingspan of 30 ft and has a shape similar to the B-2 and stealth design (see Figure 9). The UK hopes to replace manned bombers with UAVs such as this one. Some have said that the day of the manned fighter platform is gone after the current fifth generation fighters end their service.

Figure 10 U.S. UAV X-47B preparing for carrier launch (courtesy of U.S. Navy – photo by MC2 David R. Finley, Jr.).

Recently, a similar U.S. designed UAV achieved a very significant milestone. The X-47B (see Figure 10) was catapult launched from the aircraft carrier USS George H.W. Bush for the first time and later made an arrested landing on the carrier. The X-47B design took into account the corrosive saltwater environment, launch and recovery on deck, integration with command and control systems, and operation in an aircraft carrier’s high-electromagnetic-interference environment, as well as the ability to perform reconnaissance missions in its design. UAVs are now able to be fully integrated into the Navy on carriers – one of the harshest environments for aircraft to land on and take off from. This marks one of the last areas for UAVs to fully penetrate the armed services and provides better coverage around the world.

Micro- and Mini-UASs

An intriguing aspect of the micro- and mini-UAS space is UAS platforms that are hidden or blend into the environment. Some designs look like birds that sit perched on a tree and survey the area or track a target. Others are insect-like and so small that they are very difficult to observe. As the UAVs become smaller, their agility increases so that they can easily maneuver through small spaces. This allows them to move around inside of buildings without hitting any obstacles.

Researchers have also been working on software that allows these small UAVs to cooperate and fly together in formation and even break formation to go through a small space and then regroup automatically. A February 2012 Technology, Entertainment, Design (TED) video, featuring Vijay Kumar from the University of Pennsylvania, shows the results of cooperation between UAVs as they fly in formation sensing each other to keep a minimal distance in a set pattern.11 Then as they come to an obstacle too small for the formation, they cooperate by passing through one by one, regrouping in formation after they have each passed through the small space. Developing systems that allow these UASs to communicate with each other and make their own decisions is a big area of research that could allow these vehicles to take the next leap in capability. With this technology, many UAVs can work together to accomplish tasks that a single UAV would not be able to do such as lift a heavy object or perform a coordinated attack from many directions.

Figure 11 TiaLinx UAV with UWB radar sensor (courtesy of TiaLinx).

Imagine several small UAVs communicating with each other as they fly through a structure and automatically map out the inside using radar sensors and sending the layout information to those that need it. The UAVs make their own decision about which way to roam around the building steering toward the areas that are the most unmapped at the time and communicating which areas they have covered to the other units. This quickly accomplishes the task without inputs from a controller.

Improved Radars

New radars that can perform through-the-wall sensing and mapping are being developed to improve UAV capabilities. An example of this technology is found at TiaLinx which designs UAVs with sensors that operate at 5 GHz, giving them substantial penetrating capability, even at extremely low power. Some models are designed to detect motion, even a heartbeat or breathing. The company has previously stated that the device can detect people or animals more than 20 feet behind an 8" thick concrete slab. They have models that operate in the V-Band to produce sharper images. But the atmospheric attenuation at 60 GHz means this model cannot penetrate as deeply. Because these devices transmit ultrawideband (UWB) signals, they are able to obtain a more complete view of hidden objects. UWB signals are less affected by environmental factors such as rain, snow and fog that degrade the performance of many radars plus operate at low power (see Figure 11). These types of UAVs’ roles could be expanded into internal surveillance as very small form factors that can fly around virtually undetected.

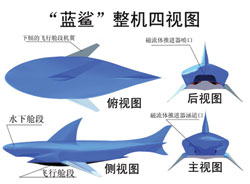

Figure 12 Blue Shark UUV Chinese concept (courtesy of Defense News).

Global Activity

Many other countries are putting a lot of resources into UAV design and development. During the AVIC Cup-International UAV Innovation Grand Prix ceremony (a contest for industry professionals) at the Zhuhai Airshow in China last November, a video was shown of the futuristic “Blue Shark” UUV (see Figure 12) diving for an attack on Russia’s Kuznetsov aircraft carrier.12 Many of the contestant submissions were of near-space UUVs and hovering ground-attack heavy UAVs.12 A recent report states that China uses UAVs for intelligence, surveillance, and reconnaissance (ISR) missions and communications relay, but likely is developing and operating UAVs for electronic warfare (EW) and lethal missions.13 China, like the U.S., is incorporating UAVs into non-defense missions such as border security, maritime surveillance, and humanitarian assistance/disaster relief. The Chinese presence is expected to grow in the international market as they have far fewer restrictions than the U.S. for military exports.

Israel is a major operator and producer of UAVs, with three air force squadrons equipped with Heron, Hermes 450 and Searcher craft, as well as the giant Eitan14 and as stated previously, probably is the largest exporter of UAVs globally. Israel is considered to be second to the U.S. in UAV technology. UAVs play a key role in battling Gaza rocket launchers as they perform surveillance and identify rocket launcher positions. They are working on UAVs to take over many tasks that are currently performed by manned aircraft.

CONCLUSION

UAVs are an exciting area of development that is progressing quickly. While the overall market is growing, the U.S. military market will decline in the next few years as the U.S. pulls out of Iraq and Afghanistan. However, the U.S. commercial market is expected to grow significantly as military sales decline providing that legislation is passed to incorporate UAVs into the national airspace. New commercial applications such as border security, public safety and farming are expected to find many benefits from the use of UAVs. Growth is also expected in foreign military markets as the technology becomes more widespread.

RF and microwave companies can participate in this market growth with technologies that reduce SWaP such as GaN amplifiers, highly integrated radio transmitters and receivers, MIMO and conformal antennas, light weight cables/connectors, plug-and-play sensors and low power systems. The market for smaller mini- and micro-UAVs will demand further miniaturization of electronics and other key components as the commercial market expands.

REFERENCES

- The Unmanned Systems Integrated Roadmap FY2011- 2036, Department of Defense, 2011, Reference Number: 11-S-3613.

- www.upi.com/Business_News/Security-Industry/2013/03/19/India-predicted-as-boom-market-for-UAVs/UPI-63951363714961/#ixzz2U7jmaIfl

- www.marketresearchmedia.com/?p=509

- www.asdnews.com/news-48569/Defense_and_Security_UAV_Market_To_Experience_Radical_Changes.htm#ixzz2U7uvENN4

- http://higherlogicdownload.s3.amazonaws.com/AUVSI/958c920a-7f9b-4ad2-9807-f9a4e95d1ef1/UploadedImages/New_Economic%20Report%202013%20Full.pdf

- www.upi.com/Business_News/Security-Industry/2013/03/19/India-predicted-as-boom-market-for-UAVs/UPI-63951363714961/

- www.upi.com/Business_News/Security-Industry/2013/05/21/Growth-seen-for-Israels-UAV-exports/UPI-39691369145986/

- www.csmonitor.com/USA/Military/2009/1211/Drone-aircraft-in-a-stepped-up-war-in-Afghanistan-and-Pakistan

- www.asdnews.com/news-49298/US_drone_strike_kills_six_in_Pakistan:_officials.htm?HASH=fb0de660f95a5ce75ff8cc312544bc8b&utm_source=ASDNews&utm_medium+email&utm_campaign=ASDNews+Daily+Z1&utm_content=phindle&40mwjournal.com

- www.nasa.gov/directorates/spacetech/centennial_challenges/uas/index.html

- www.ted.com/talks/vijay_kumar_robots_that_fly_and_cooperate.html

- http://blogs.defensenews.com/intercepts/2012/11/zhuhai-uav-concepts-look-futuristic/

- http://origin.www.uscc.gov/sites/default/files/Research/China%27s%20Military%20UAV%20Industry_14%20June%202013.pdf

- www.upi.com/Business_News/Security-Industry/2013/05/20/Israel-said-to-be-world-leader-in-UAV-exports/UPI-44811369066024/