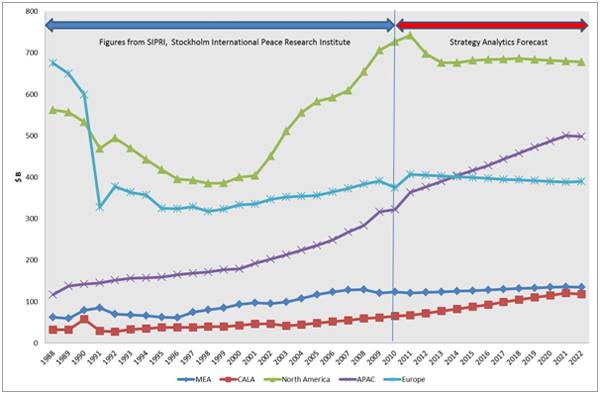

Military expenditure faces challenges with declining budgets impacting the introduction of new platforms. However, technology will be the differentiator for future global conflict scenarios, and budgetary constraints will not detract from the need to improve system capabilities through technology upgrades. Strategy Analytics forecasts the opportunity for RF technologies remains strong despite budgetary challenges as the focus shifts towards enhancing capabilities in the areas of radar, satellite communications and electronic warfare.

The challenges facing North America, and the US in particular are well documented, and European spending is also forecast to decline over the next ten years, though this will not detract from an emphasis on maintaining and enhancing the capabilities of existing platforms and systems. From a defense industry perspective, opportunities for growth will come from the Asia-Pac, CALA and MEA markets as these regions increase defense spending. The largest growth is expected to come from the Asia-Pacific region, with growth expected in Chinese military expenditure. This will be supplemented by defense expenditure increases in other countries in the region, e.g. India, Japan, South Korea etc., driven by both reactionary spending (to China) as well as a desire to maintain and develop future capabilities.

Future capabilities for radar, satellite communications and electronic warfare will be underpinned by operation across wider bandwidths and higher frequencies. The need for bandwidth, for example, shows no sign of abating with net-centric warfare driving demand and this drive a move towards higher frequencies across all applications. The trend is especially notable in the communications sector with Ka-band expected to form an increasingly staple part of the military satellite communications portfolio over the coming years. Wide bandwidth capabilities can be epitomized by RF-based EW systems, where future trends point towards what may be described as a “no channel” concept in which the systems are tasked with operation across a complete frequency range with equal emphasis on power and sensitivity.

Looking in more detail at another area of defense communications, we see continued investment in communications capabilities with overall expenditure across land, air, naval and space domains approaching $29 billion. Strategy Analytics forecasts that the market for land-based tactical radios will grow at a compound annual growth rate (CAGR) of 7.2 percent to reach almost $4.5 billion in 2022.

Overall spending on land-based tactical radio hardware will continue to be led by North America, representing between 37 to 39 percent of the tactical radio market, over the 2012 to 2022 timeframe. Demand from emerging markets in the Central and Latin America (CALA) and Asia-Pacific (APAC) regions will also dictate high grow rates with collective demand accounting for over 46% of the market for tactical radio hardware in 2022.

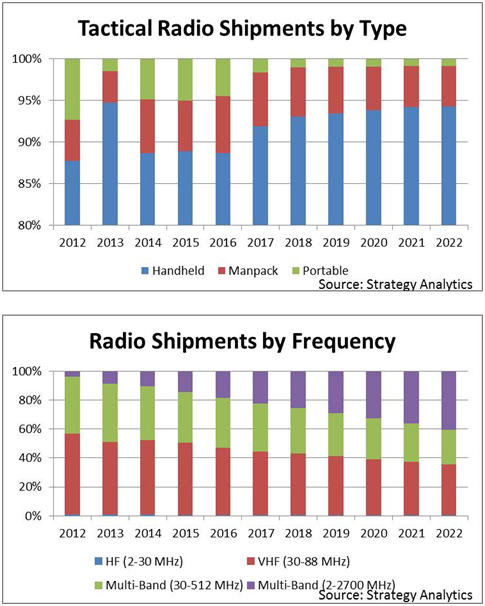

Handheld radios will represent the bulk of the market, accounting for as much as 94 percent of shipment volumes in 2022 and just over 49 percent of market value. Manpack radio shipments will also show significant growth, while portable radio shipments will remain essentially flat despite some healthy activity in the early half of the forecast.

While there will still be a market for single-band radio capabilities, the multi-band sector will be the fastest growing segment across all form factors. This in turn will drive opportunities for technologies such as gallium nitride (GaN) with the total market for electronic components predicted to grow at a CAGR of almost 14 percent, reaching $721 million by 2022.

While TWTs still offer the best solution for high power, high frequency operation and offer significantly higher overall whole system (i.e. wall plug to RF) efficiencies, there will be a steady shift away from vacuum tube technology over the next five years. This will be driven by both system architectural evolution, e.g. the move towards AESA (active electronically scanned array) radars, as well as solid-state RF technologies such as GaN and SiC demonstrating the capabilities to meet future system requirements for high frequency, wide bandwidth and high power operation. The overall (tube-based and solid-state) market for high power RF will grow at a CAGR of 9% through 2017.

The Strategy Analytics reports are available here: Defense Market Opportunities for RF Technologies and Ground Communications Systems and Components Forecast 2012-2022.