What began as a solution to poor over-the-air reception of television signals in the 1940s has evolved dramatically, in terms of content, reach and importance. CATV networks no longer focus solely on delivering TV broadcasts. Worldwide, the cable network infrastructure has been adapted to carry multiple services, adding Internet connectivity and voice telephony to traditional TV services. In addition, many countries are in the process of upgrading to digital broadcasting, as television services migrate away from analog broadcasts. The United States completed the analog to digital transition in 2009, with only a few “low power” television stations still allowed to broadcast analog content. The transition to digital broadcasting makes additional bandwidth available, and service providers are using this bandwidth to provide a whole host of additional services, such as video-on-demand, telephony, faster broadband data rates and enhancements, such as high-definition and 3D broadcasting.

As consumers continue to adopt these new services, bandwidth demand is increasing quickly, to the point where some in the industry suggest the need for doubling the bandwidth capability every two years. Cable operators are increasingly competing with traditional telecom carriers, as both fight for the lucrative bundle of “triple-play” services (voice, video and data). With no existing video networks, some of the telecom carriers are turning to the high bandwidth capability of multi-wavelength or multiplexed fiber networks to deliver their services to customers. Traditional cable operators are responding with Hybrid Fiber Coaxial (HFC) networks, with the fiber portion pushing deeper into the network. The challenge for either type of operator is to provide a range of diverse, high-bandwidth capabilities and services that keep pace with customer demand without investing too heavily or too quickly in capital-intensive infrastructure.

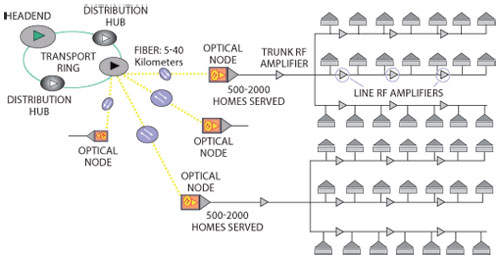

Figure 1 HFC network topology.

Architecture

The video signal in a traditional CATV HFC network (see Figure 1), originates at a Multiple Service Operator’s (MSO) headend. This facility receives television programming through “over the air” transmission or landlines for local channels and satellite transmission for national channels. The antennas and electronics in the headend receive, process and insert any additional programming required by local governing agencies or the cable operator. The resulting channel lineup is then distributed to the customers of the CATV provider.

In the HFC network, video channels leave the headend as optical signals on a fiber transport network. As the diagram illustrates, this signal splits a number of times until it reaches an optical node that typically serves between 50 and 2000 premises. This optical node contains electronics to convert the signal from the optical domain to the electrical domain for further transport on a coaxial network.

From here, the signal will likely undergo additional splits, until it reaches a consumer’s premises. Once the optical signal is converted to the electrical domain, coaxial cables transport it to customer premises. Splitting the signal, as well as the loss of the coaxial transport cable, increases the loss of the transport network significantly. To offset this loss, a variety of amplifiers (system or trunk amplifiers, line extenders, drop amplifiers, etc.) are inserted to offset the path and splitting loss experienced in the CATV infrastructure. Typically, each node will have one system or trunk amplifier prior to a splitter or tap. After the signal splits, the subsequent run into a neighborhood typically incorporates three line extender amplifiers to compensate for signal loss. A single optical node may serve anywhere from 50 to 2000 homes, with the actual number varying based on region, bandwidth requirements and geography. The number of homes passed per optical node is trending downward as bandwidth intensive applications, primarily centered on video, proliferate. Many current estimates place the number of homes passed per optical node below 500. While some older networks still operate at lower frequencies, this “forward” or “downstream” path is being rapidly upgraded to cover roughly 50 to 1000 MHz of bandwidth. There is also ongoing discussion in the industry about the need to increase the highest frequency of operation in response to the desire for new services and channels.

With its roots in improving reception of over-the-air analog broadcast signals, it is not surprising that initial CATV networks were one-way. As operators have added new services such as Internet connectivity, voice telephony and video on demand, the networks have evolved to accommodate the two-way nature of these communications. The return path, also known as upstream transmission, is a segment of the CATV frequency band that has been set aside to accommodate the required interactivity. The frequency allocation for the return path depends on the region and color-encoding scheme in use. In North America, Korea, Taiwan, Japan, the Philippines and parts of South America, the National Television System Committee (NTSC) developed the original analog encoding scheme and these systems use a 5 to 42 MHz return path with 6 MHz channels. The rest of the world use Phase Alternate Line (PAL) or Séquentiel Couleur à Mémoire (SECAM) encoding for their original analog CATV networks. These analog schemes use 5 to 65 MHz as the frequency range for the return path with 8 MHz channels.

Recent Developments

This is an industry that, until recently, had not seen a tremendous amount of innovation in the preceding 60 years. A large part of the reason for this is the enormity of the “physical plant,” the actual hardware of the networks. The National Cable and Telecommunications Association estimates operators in the U.S. spent slightly more than $157 billion dollars on CATV infrastructure since 2000. Even with this massive outlay of capital, it was becoming increasingly difficult to justify investment to increase network bandwidth incrementally or offer some additional analog channels. The conversion to digital channels and the tremendous surge in demand for video content and faster broadband speeds is changing this situation quickly.

Much of the world has either completed or is well down the path for conversion of their analog television stations to digital. The benefits are enormous. In the U.S., with the new standards for digital transmission, an existing 6 MHz analog TV channel provides a 19.39 Mbps data rate for digital signals. This channel can be sub-divided into many, lower data rate “standard” definition channels or the operator can offer a smaller number of HDTV or 3D channels.

Operators are supporting this CATV network upgrade because they are finding ways to generate new revenue streams. Consumers are embracing video and operators have responded with more (and higher quality) on-demand movies, faster (and more expensive) Internet packages based on DOCSIS 3.0 standards and more diverse channel offerings. The increased number of channels not only allows MSOs to broaden their channel offering, it also allows them to tailor their offerings and increase advertiser revenue with the concept of Switched Digital Video (SDV).

In a traditional CATV network, all subscribers have all channels passing their premises. Pay channels and other subscription services are filtered out, so that a subscriber only receives what they pay for. Despite a large offering of television channels, studies report that 80 percent of the viewers, in a given area, are watching the same twenty shows. The other channels are consuming bandwidth without much usage. SDV takes a more selective approach by offering the most popular channels on a system-wide basis. The logistics for these channels remain the same: to view one, the set top box (STB) or tuner selects that frequency from the network-wide channel stream. If you select one of the channels not contained in this grouping, the logistics change. In this case, the consumer’s STB sends a signal to the access system in the headend, requesting that channel. Operators feel tailoring offerings to groups, whether they are regional, ethnic, same interest, etc., will be attractive to advertisers looking to increase payback on advertising spending. Many of the large MSOs are deploying SDV networks on varying scales. Comcast is already deploying these networks in certain areas and it feels it can re-coup enough bandwidth to offer an additional 150 HDTV channels.

Fig. 2 Line extender amplifier (courtesy of tonercable.com).

AMPLIFIER Device Developments

Figure 2 shows a typical example of a line extender system amplifier. This network-level device contains a forward and reverse amplifier path and both of these paths typically contain a number of passive elements like equalizers, attenuator pads, baluns and duplexers. These system-level amplifiers will have different names and performance specifications depending on where they are located in the network architecture, but they all must perform bidirectional amplification of signals with little added distortion. To support the network evolution, the semiconductors used in the amplifier building blocks are also undergoing rapid change.

Befitting the sixty year heritage, the early amplifiers were constructed with discrete silicon bipolar junction transistors (BJT). These amplifiers incorporated all the tuning, active and passive elements, using hybrid manufacturing techniques, into what the industry refers to as “hybrids.” In early deployments with a limited number of analog channels, the performance of hybrids incorporating silicon BJTs easily met the network requirements.

Hybrid amplifiers, the fundamental building blocks for the array of system-level amplifiers used in an HFC network, now use either silicon bipolar or GaAs technology. Over the past decade, GaAs has been supplanting silicon bipolar technology for networks where operators are seeking to offer advanced services and applications. The conversion from analog to digital broadcasting typically provides the opportunity to operate at a higher frequency and broader bandwidth, in addition to more stringent performance requirements. These new requirements favor GaAs parts fabricated using a PHEMT process that can provide better linearity and efficiency performance.

With the analog to digital conversion largely complete in the U.S. and Western Europe, much of that infrastructure has adopted GaAs as a preferred technology. The counterpoint to this trend is evident in the emerging Asian economies of China and India. In these countries, the conversion to digital broadcasting is at a much earlier stage and the cost pressure is severe. Strategy Analytics estimates silicon-based hybrid amplifiers still make up a substantial portion of the CATV infrastructure amplifiers used in this region, but we anticipate strong growth from GaAs devices as network requirements evolve.

Fig. 3 Amplifier building block topology.

As network performance requirements evolve and GaAs performance improves, designers are using more GaAs-based MMIC amplifiers as the building blocks for network amplifiers. Even though GaAs MMIC amplifiers offer the size and repeatability benefits of a wafer scale process, the highest system power amplification requirements, closer to the headend are still using hybrid amplifiers. Use of a hybrid versus MMIC gain block varies somewhat, according to the requirement and equipment manufacturer’s preference. Research suggests that typical penetration of hybrids is approximately 80 percent in system amplifiers located after the optical node in HFC networks and approximately 75 percent in line extenders used to compensate for splitter and line loss of the signal.

Conversely, as the signal gets closer to the customer premises, the power output and price decrease while the quantity increases. The final amplifier in the HFC network architecture is typically called a “drop amplifier.” This represents the last amplification stage before a signal enters a customer’s premises and is just about exclusively a MMIC design. The power output trend for this amplifier is actually increasing. As network services have increased, the set top boxes have become more sophisticated and complex. The addition of multiple tuners, hard drives for DVR functionality and multiple input and output ports for associated electronics have all increased the RF signal loss in the set top box. This increasing power output and stringent linearity requirements look likely to allow GaAs to maintain an edge over SiGe for this function.

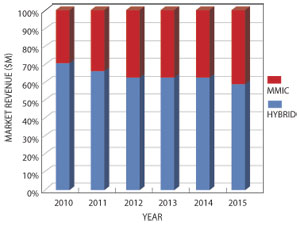

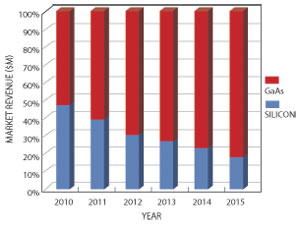

Figure 3 shows the latest Strategy Analytics estimate of how MMICs will capture market share from hybrid technology in CATV infrastructure. The trend of GaAs becoming a dominant technology for CATV infrastructure is even more apparent when looking at the latest Strategy Analytics forecasts for market revenue segmented by semiconductor technology. Figure 4 shows that we anticipate that the GaAs content in system-level amplifiers, whether in hybrid or MMIC configuration, will increase from slightly more than 50 percent in 2010 to more than 80 percent in 2015.

Fig. 4 Amplifier building block technology.

GaN in CATV Amplifier Building Blocks

Probably the most interesting semiconductor development in the CATV market segment is the rapid adoption of GaN technology for amplifiers. The defense industry has long championed the benefits of GaN technology, specifically the ability to deliver high power at high frequencies and to withstand high temperatures. This performance stems largely from the GaN’s wide bandgap (3.4 eV), high breakdown voltage, high power density and high gain at microwave frequencies. Until recently, however, the technology has struggled to gain a foothold in commercial market applications.

Within the last couple of years, CATV infrastructure applications have emerged as the leading commercial market for GaN-based RF components. This market application has blossomed as devices that are genuinely competitive with silicon and GaAs technology are being developed. GaN performance advantages are providing system benefits in a couple of ways.

For high power system applications, GaN-based amplifiers match the performance of incumbent GaAs components with lower power consumption. Device manufacturers claim an energy savings of up to 25 percent. This benefit is finding wide acceptance among operators because they can reduce their operating expenses, which represent an increasingly significant fraction of the overall cost of running a network. These GaN-enabled networks are being positioned as “green” because of their reduced energy consumption. This appears to be the most prevalent reason cited by operators for the use of GaN devices.

The second differentiating feature that is increasing GaN amplifier adoption in CATV networks is the higher output power and better distortion performance of the technology. The ability to use fewer RF amplifiers in the HFC network was actually the first benefit equipment providers touted to CATV operators. Initially, this approach did not meet with much acceptance because operators were reluctant to use an unproven technology and reconfiguring the network layout meant “truck rolls” and additional costs. However, as operators embrace the “green” benefit of lower operating costs, the usage history is being established and operators are using the superior output power capability of GaN to increase the spacing between amplifiers in new “greenfield” applications.

There are still challenges for even wider adoption of GaN, however, with the largest being cost. Strategy Analytics believes that GaN products are currently selling with a price premium of 15 to 30 percent over competing GaAs technologies. To date, the performance advantages and system cost savings make this an acceptable premium for the CATV industry. The bigger issue may be that opponents of GaN claim this price premium does not reflect the true cost differential and is not sustainable.

A big cost element is the lack of suitable native GaN substrates on which to grow lattice-matched, defect-free epilayers analogous to GaAs or silicon transistor fabrication. In the absence of production-scale, single-crystal GaN wafers, manufacturers must instead use foreign host materials such as sapphire, SiC or silicon. SiC has been the material of choice for RF applications, thanks to its relatively close lattice match to GaN and its excellent thermal conductivity properties. While material and process improvements have helped with the quality of SiC wafers, it remains a difficult and expensive material to produce.

Recently, high-resistivity silicon has become a viable alternative to SiC for certain GaN applications. Although the lattice match with GaN and the thermal properties are not as good as SiC, silicon does provide the potential for lower cost devices. There are GaN-on-Si devices for other market applications and development activity for RF applications, but the vast majority of devices currently used in CATV applications are GaN-on-SiC. With pricing pressure as the driver, it will be interesting to see how the two processing methods evolve.

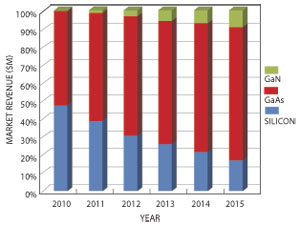

Fig. 5 Amplifier building block technology (including GaN).

GaN activity for CATV applications is substantial, as recent announcements illustrate. RFMD began pre-production shipments of GaN-based CATV hybrid amplifiers at the end of 2009. They anticipate revenue of $4 to $5 million from GaN-based amplifiers for CATV applications in 2012 and they expect this will double in 2013. These applications typically consist of power doubler devices that use GaAs PHEMT drivers and GaN HEMT output stages. Nitronex has revealed shipments of more than 200,000 GaN amplifiers to a U.S.-based CATV amplifier supplier and, in August 2011, Anadigics announced that they had incorporated GaN into their surface- mount CATV line amplifier portfolio.

Figure 5 revisits the CATV amplifier market revenue segmentation, with GaN added. As the chart shows, Strategy Analytics estimates shipments of GaN-based amplifiers began in 2010 and they will capture market share very quickly. We forecast the market value will grow with a Compound Average Annual Growth Rate (CAAGR) in excess of 150 percent to reach nearly $25 million in revenue by 2015.

Conclusion

This is an exciting time in the CATV industry for consumers, operators, equipment suppliers and device manufacturers. An industry that had seen little change in its first 60 years is undergoing a dramatic upgrade in capability, in response to the explosion of video consumption. Services like digital TV, HDTV, 3D TV, video-on-demand, pay per view and targeted programming are being embraced by consumers. The bandwidth and technology requirements to meet these consumer demands are driving new network architectures and compound semiconductor technologies, most notably GaN, are enabling these new architectures.